Can I Change My Car Loan Term

If you have the right to rescind you can cancel your loan in the three-day window for any reason or no reason at all. Car loan terms commonly range from three to five years although shorter and longer terms are available.

Bad Credit Car Loans 24 Hours Approval Best Lenders Bad Credit Car Loan Car Loans Car Finance

While you cannot change the terms of a new car loan sometimes in certain circumstances the dealer may call you back in to sign new.

. I have 2 loans with a national bank. If you refinance and then rescind the refinance loan you will still have to pay the original loan. Up to 8 cash back A persons financial situation can change while they are paying off a car loan and if it changes for the worse then it will be difficult to make the payments on time each month.

Can I change my car loan tenure. The trend is actually worse for used car loans where just over 80 of used car loan terms were over 60 months. Get a finance settlement figure.

In the past I have made payments to the loan and to the principal balance. Your right to rescind doesnt change your obligation to make payments on any of your other loans. Unless you completely pay off your 72- or 84-month car loan before you buy another new or pre-owned car youre likely to be stuck in a cycle of.

Each bank or lender has specific refinancing requirements so be sure to ask about the details. However if you made your purchase from a dealership and want to refinance something else. Generally youll make monthly payments until the term reaches maturity ie until you reach the designated end of the auto loan.

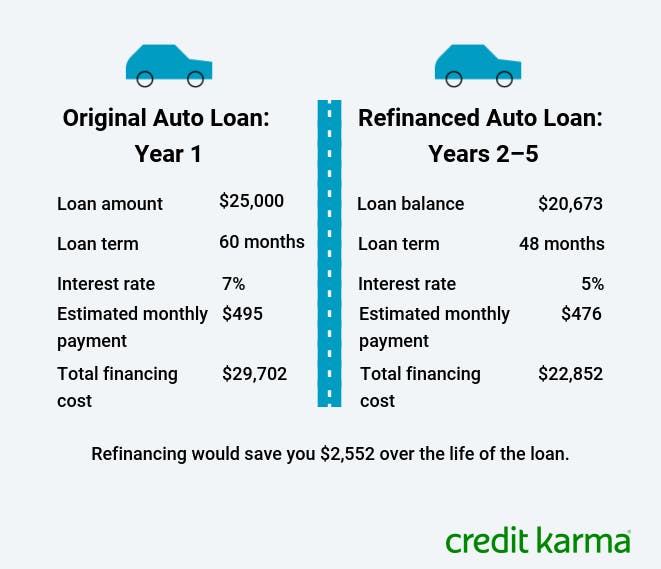

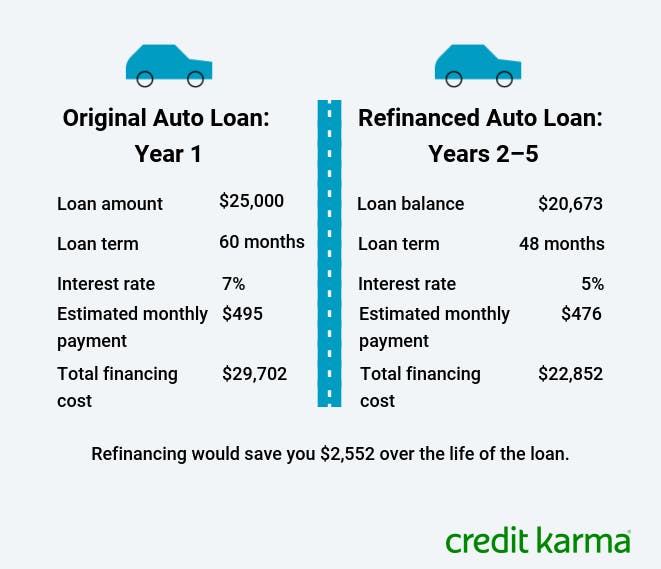

After a year of payments on this loan your balance is now 20673. You can reach an Upgrade Customer Support representative by dialing toll-free 844-319-3909 Monday-Friday 5am-7pm Saturday and Sunday 5am-6pm Pacific Time. This reduces the amount of debt you are paying interest on and not just make an early payment which is broken down into an IP interest and principal.

They then may ask you to. In theory you can change your car loan due date but that depends entirely on the financial institution that financed your loan. For example if you have 7500 or more remaining on your car loan 8000 if the loan was made in Minnesota and the car is less than 10 years old with fewer than 125000 miles on it you may be eligible to refinance with Bank of America.

Can I cancel a car finance agreement. While you can finance a car for up to 96 months how long you finance a car really depends on your unique needs wants and cash flow. Some shoppers opt for a shorter loan term that comes with higher monthly payments and reduces the total cost of the loan.

A loan for a home and personal loan. Some financial experts recommend 48-month loans for new cars. Use this calculator to determine 1 how extra payments can change the term of your loan or 2 how much additional you must pay each month if you want to reduce your loan term by a certain amount of time in months.

However I am sure you signed numerous documents when you purchased the car so you need to review and re-read them all to verify that the dealrship truly represented and promised 19 APR and that you are. The most common loan term for a used car in the first quarter of 2022 was 72 months. The best way to do so is through an online application that returns your annual percentage rate APR immediately.

But this would imply that the interest rate and the amount of installment will change accordingly. Common Auto Loan Terms Standard-Term Loans. There are different factors in play here but generally speaking the dealership cannot unilaterally change the terms of your agreement such as the APR.

Lets say your original auto loan was for 25000 with a 7 interest rate and loan term of 60 months. All you need to do is enter your registration. No once you choose your loan term and amount you cant change it but wed like to help you with your current application.

Most financial institutions allow you to change your due date up to 15 days after your original due date without a fee but you should contact your provider and see if that applies to you. Its Hard to Break the Cycle of Long-Term Loans. An auto loan term is the amount of time you have to pay off your car loan.

If you keep this loan youll end up paying a total of 29702 on the loan. Then your car needs valuing which is super simple with our Sell Your Car tool. This practice is sometimes called spot delivery In some cases after you drive away with the vehicle but before the sale is finalized the dealership will later tell you that they couldnt make the loan at the agreed-upon terms.

Simply put if you sign up for a. Until fairly recently 60-month auto loan terms 5 years were a fairly common car loan term length. Others opt for a longer loan with lower monthly payments to assist with.

Firstly youll need to get a finance settlement figure from your lender and ensure the V5 certificate is in your name. To lower your monthly payments on your Wells Fargo auto loan you need to find a lender that can extend your used car loan term or who offers lower auto loan rates before the loan is paid in full. Try different loan scenarios for affordability or payoff.

Create amortization schedules for the new term and payments. Remember that longer loan terms come with higher interest rates meaning youll pay more for your automobile over the life of the loan. How do I change my car before the end of my finance agreement.

Some dealers will allow the customer to take possession of the new vehicle before the loan is approved by the lender. Get your car valued. No you usually cannot do this.

Yes you can change the tenure and amount of the loan. This happens to many car owners and the usual course of action is either to sell the car in order to pay off the loan or refinance to adjust the terms of the loan making the.

When Does Refinancing A Car Loan Make Sense Credit Karma

Becoming Her On Instagram Cash Is King And Credit Is Power You Could Be Leaving So Much On The Table Good Credit Credit Repair Services How To Fix Credit

Car Loan Payment Agreement How To Draft A Car Loan Payment Agreement Download This Car Loan Payment Agreement Templa Contract Template Car Finance Car Loans

Comments

Post a Comment